Should you save a business document or destroy it? Companies and organizations have tons of crucial documents to manage. You wish to maintain data that may be useful in the future but require as much storage space as feasible. This blog article will discuss which papers should be kept and which should be discarded. A small caveat before we begin: consider these suggestions as a starting point. A legal or financial professional can provide individualized advice on the best record-keeping techniques.

List the Documents Critical for Your Business

Records to Keep Forever

Several papers must be kept indefinitely. These are the essential items you may require in the future for various purposes. When they are required, you will save a great deal of time by keeping them in a secure location and securing a copy.

Examples of academic records include diplomas, transcripts, and any portfolio work that may be utilized in the future when seeking a project.

- Employment documents include all provisions, agreements, disciplinary files, and performance evaluations.

- Medical records

- Military document indexing

- Passports

- Pension and retirement records

- Social Security documents

Documents to Be Kept for a Specified Time

Imagine having financial statements and bills from your whole life stacked on your desk. Even after only a decade, that stack would likely be enormous. There are several documents, most of which are financial, that you should save for a specific amount of time but not forever. You may need to refer to them monthly or weekly for a time, but after that, they are only a source of clutter.

Knowing when to dispose of these sorts of documents is difficult. There is no perfect solution to every question, but there are criteria based on what it is:

- Credit card statements should be kept for 60 days unless they contain tax-related charges. In this instance, you should keep them for three years.

- Statements of account: one month

- Tax and warranty-related bills should be kept for one year; all other bills to shred immediately after payment.

- Checks and pay stubs: One year or until you receive your W-2 for the tax year.

- Seven years after closing the investment account or selling the asset.

- Seven years, including your tax return and supporting papers such as W-2s and invoices.

- Save sales receipts for the guaranteed duration for big purchases such as appliances and electronics. For items such as food and apparel, save the receipt until you are certain it will not be required to return the item.

- Keep records even after the sale of the assets

What Files Can You Shred?

Shredding documents is the primary method for preventing identity theft. As a general rule, there are specific documents that must be shredded.

If papers are still “active” and you need to save them for future reference, file them according to the topic in your home filing system. Shred them only when they are no longer required.

What Records to Shred

When you are finished with these documents and no longer require them, you may destroy them:

- ATM receipts

- Bank statements

- Void and cancelled checks

- Credit card expenses

- Credit files

- The issuance of licenses (expired)

- Employer identification documents, including any identifiable information

- Portfolio account numbers

- Legal documents

- Transactions in investments, stocks, and properties

- Objects bearing a signature (leases, contracts, letters, etc.)

- Medical and dental records

- Documents bearing a Social Security number

- Passwords or Personal Identification Numbers

- Pay stubs

- Pre-approved applications for credit cards

- Receipts including bank account numbers, credit card numbers, or other identifying information are suspicious.

- Fiscal forms

- Transcripts containing identifying data

- Travel Itineraries

- Previously-owned airline tickets

- Utility expenses

Everything else, including document indexing, may be recycled. Set up a flexible filing system to maintain control over these papers. Additionally, it’s a good idea to make a habit of regularly reviewing your stored documents. Try to do this while paying bills, filing taxes, or handling a similar recurrent duty to avoid forgetting and letting your papers pile up.

When to Shred Some Business Documents?

Some files can be placed in the shredder after a predetermined period. Your industry’s requirements may assist you in determining when to trash company documents. Use the following recommendations for shredding:

- Documents Relating to Taxes: Depending on your filing status, the IRS provides several guidelines for tax record-keeping. Some firms are permitted to preserve their tax records for three years, but the IRS advises others to keep them indefinitely.

- Contracts: Keep contracts for four to six years beyond their expiration date. They become useful when a legal problem occurs.

- Insurance Records: An insurance file is also useful as legal paperwork. Keep insurance paperwork for at least six years following expiry.

- HR Records: Employee information in HR Documents might be useful for years beyond an employee’s departure. Personnel records can be kept for at least seven years. Medical records may become valuable up to thirty years after expiration.

- Consult a reputable financial or legal professional for further information regarding these deadlines. When unsure, retain a document for at least three years.

Documents Which You Should Not Shred. Instead Store.

The experts advocate retaining the following records indefinitely:

- Audit accounts

- Registries of capital stock and bonds

- Patents and intellectual property rights

- Currency books

- Pension records Permits and licenses

- Construction costs, leases, and plans

- Plans for retirement and savings

- Legal correspondence

How Can You Store Your Heap of Documents Without Renting Extra Office Space?

Organizing Files Correctly

You may prevent mistakes with file organizing by adhering to a few straightforward rules. The actions outlined below will go a long way toward guaranteeing that your documents are safely stored and maintained in good condition.

-

Begin With The Fundamentals

Always utilize sturdy boxes and packaging supplies. It is tempting to purchase cheaper storage boxes and packing materials to save a few Euros. After all, they will only be in storage; what could go wrong? The worst-case scenario is returning to your file storage and finding collapsed boxes and paperwork all over the place.

Documents are heavy, and inexpensive containers are frequently brittle and inadequate for the task. The first step to proper document storage is to make a small additional investment in high-quality boxes and packaging supplies.

-

Ensure that documents are dry

This doesn’t mean that every document needs to be dried with a hairdryer; rather, it means that particular safety measures must be taken when storing papers from wet construction sites or workshops. In the worst instance, mold and mildew might spread quickly to nearby documents and destroy precious records.

-

Consideration of the Storage Environment

For the same reasons, important documents should never be kept in a humid environment. Paper and moisture do not get along, and papers will quickly deteriorate in a humid climate.

The temperature of the storage space needs to be considered as well. You should ideally keep papers at a fairly consistent temperature. The optimal temperature is regarded to be approximately room temperature. It is a good idea to consider climate-controlled storage for more sensitive and critical papers.

-

Label Boxes Appropriately

As it is relatively easy to shorten labelling when preparing files for storage, inadequate labeling is likely one of the most prevalent errors. However, this could lead to much confusion when looking through boxes of archives for a critical tax document a few years later.

Proper labelling that precisely identifies the contents of each box and the corresponding dates may save a great deal of time and frustration in the future. Begin with a system that employs a consistent technique for naming, categorizing, and dating boxes. Additionally, ensure that a record of the archiving process is maintained and that future archiving follows the same procedure.

-

Resist the Temptation to Overstack

While stacking boxes high may short-term save space, it has long-term consequences. First, pulling heavy boxes from the top of towering stacks could result in injury. However, this only applies if the stack is still upright!

People frequently return to their document archives and find collapsed stack boxes because the bottom packages can’t support their weight. Always verify that the storage capacity used for document archives is sufficient to meet your demands without your document stacks towering to the heavens.

-

Prepare Your Storage Space

Plan your storage to make it easy to recover documents when needed. Knowing precisely where in the unit to search for payroll reports, for instance, will facilitate document retrieval. It is also a good idea to keep papers that may need to be accessed more regularly in more accessible regions while storing less critical documents in less accessible areas.

-

Edit Your Files Before Storing Them

Another common mistake is keeping everything, regardless of need. However, since space is money, you may save money and make data easier to find and manage by clearing out unnecessary paperwork and organizing your file storage.

When in doubt, it is instinctive to file every scrap of paper to be safe; this is always the wisest course of action. The majority of a company’s paperwork can be thrown away without needing to be archived.

Should You Digitize Your Business Documents?

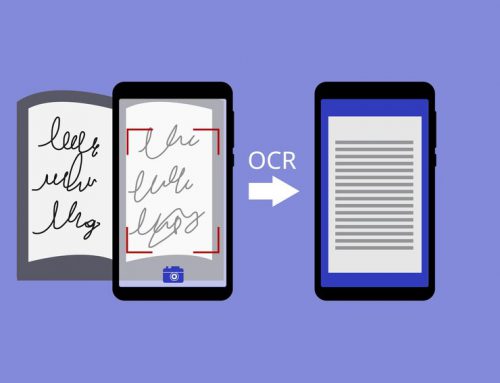

Now that we live in a technology era, it is inevitable that you will ultimately transfer all of your files to an online filing system. You can continue to store paper copies, but switching to a digital file system will save you a great deal of time and money. The documents are centralized and accessible from practically any computer or mobile device.

The scanning of all your current papers will likely take some time. However, once it is operational, you will be able to distribute copies to anyone who requires them. In this way, filing works similarly to paper: scanning the document and classifying it appropriately.

What Are the Advantages of Digitization of Paper Documents?

Here are the greatest advantages of digitizing documents:

- Digitization of paper documents enables an organization to access data in digital format from any place, removing the limitations of geography, time, and simultaneous access. Data that is easily accessible improves data flow within a company, resulting in increased productivity.

- Document digitization helps an organization dispose of tangible papers that use numerous resources, including office space, security employees, and a decomposition-free atmosphere. Once the data is digitized, these resources may be optimized for cost savings.

- With the digitization of papers, it is simple to specify access to digital material. Digital access shortens the time it takes to provide access and makes it possible to choose the amount of access.

- Data breaches are avoided by data security. Data security is easy to maintain with the right cyber security. If data is not digitized, it might be accessed by numerous departments concurrently and requires more time and effort to obtain.

- Digital data may easily be stored across different places while maintaining data security. Having many data storage locations offers additional defence against data loss and corruption. In natural disasters, physical papers are more likely to be harmed than digital data, which is more secure and simple to copy. Natural disasters are frequently unpredictable; therefore, keeping your papers in several certain locations increases their dependability.

- Digital data can be easily manipulated and does not require printing to be distributed. To distribute the information, all you need is an email, which eliminates the necessity for printing. This will eventually result in the conservation of natural resources. It is much easier to find different records instantly when you have access to digital data. You can perform diagnostic analysis, which can provide important details.

Wrapping Up!

Before choosing a document management system for your business, consider the requirements for storage space, sorting and finding capabilities, and security. Take into account the system’s hosting location as well. Which option—an on-site solution or a third-party managed cloud-based document service—would you pick?

Opt for a service that allows you to put permission limitations on certain files since this will enable you to manage which staff have access to which documents. Additionally, a cloud-based system is ideal since it allows users to access data from any device with an internet connection. This function is very important for businesses with remote employees.

The greatest document conversion services facilitate smooth teamwork and collaboration. It shouldn’t be necessary for you to manage your digital papers with a variety of applications. Make sure your program has features for automatically formatting scanned files to the office or industry standards, document-generating templates that can be customized, and picture functionality that is compatible with your scanner.

Many workflow automation options are useful since they let you create, edit, review, and approve all scanned business documents. You also need a system that will allow you to import multiple types of digital documents, including word processing, spreadsheet, and PDF files.

Leave A Comment